Learn how to determine what’s truly important to customers.

By Ken Donaven

As in virtually any industry these days, employee migration and job turnover are bringing some fresh faces to the realm of Customer Insights. This talent turnover serves as a good reminder to revisit and reinforce some of the basic “blocking and tackling” that market researchers rely on to uncover critical (but often hidden) customer insights. These insights may be enlightening to both new market researchers and those who will never formally sit in an insights chair, but for whom market intelligence is paramount.

One common methodology we frequently undertake for brands is a process for determining Key Purchase Criteria for a given product or category. What’s important to understand is that such research must go beyond merely asking survey respondents to offer their stated criteria for product selection, as that only tells part of the story.

Without doing a complete analysis of the true drivers of customer satisfaction and how that aligns with purchase decisions, brands may be getting only part of the picture, or perhaps even the wrong picture. This may lead to companies operating, messaging, and developing their products based on incomplete information or incorrect assumptions.

Hearing Things Your Customer Might Not Be Telling You

When conducting surveys or interviews with customers, brands often ask what is most important when determining which products or services to buy. This provides data on what we call “stated importance,” which we can track and categorize as attributes important to customers or prospective customers for a brand’s goods or services, as stated and offered openly by the respondents.

However, asking what’s important only provides half of the story. The other critical half of the equation is what’s known as “derived importance.” This is determined by customers defining their level of satisfaction with various attributes of the product or service, revealing another (often different) set of importance criteria. These factors may not be openly “stated” by respondents, but they certainly contribute to customer satisfaction, and ultimately, future purchases, referrals, reviews, and testimonials.

The analysis to determine Key Purchase Criteria, then, is a multi-step process, starting with importance and satisfaction questions in a survey.

- Respondents are asked to rate or rank the importance of various product/brand attributes (via either scaled-response questions or a MaxDiff exercise).

- Respondents are asked to rate supplier performance across those same attributes.

Then, the data is analyzed to understand the complete picture of customer needs and preferences:

- Determine what respondents say is important.

- Understand the relationship between their satisfaction with each attribute and their overall satisfaction with each brand, which yields “derived importance.”

- Compare “stated importance” to “derived importance.”

- Create a “Customer Needs Analysis” to understand the relationship between “stated importance” and “derived importance.”

- Evaluate customer satisfaction for all attributes through the prism of this “importance lens.”

There are two primary benefits of conducting a Customer Needs Analysis: first, companies can take hundreds, or potentially thousands, of expressed customer preferences and purchase criteria and better understand what’s truly important to the customer when making purchase decisions. Second, the insights gleaned provide the opportunity to create a visualization that compares both importance metrics and a quadrant analysis to determine critically important attributes.

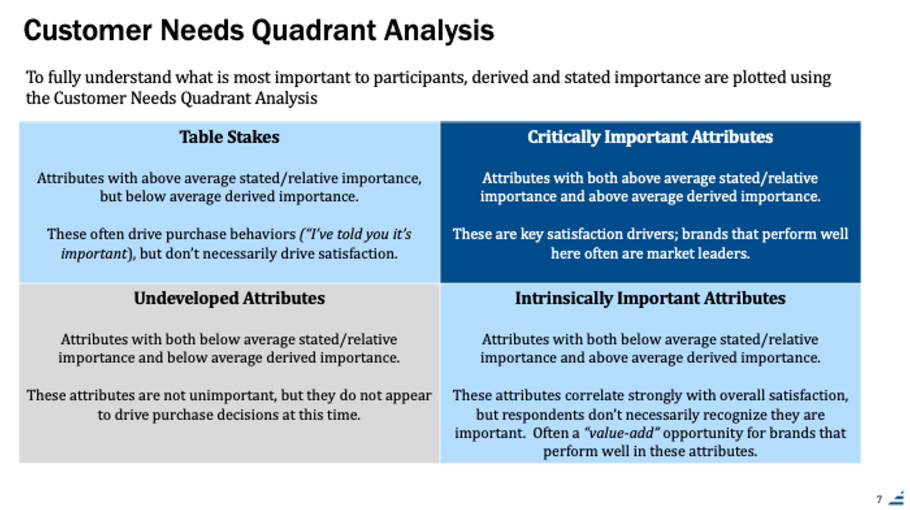

The text in each quadrant above describes the different levels of importance customers may assign to a product or brand. Be advised! There are meaningful differences among “Table Stakes” attributes (areas in which a brand must perform well to be in the consideration set); “Critically Important” attributes (areas that determine the market leaders); and “Intrinsically Important” attributes (areas in which a brand may provide added value to customers).

Harnessing Hidden Insights to Drive Better Performance

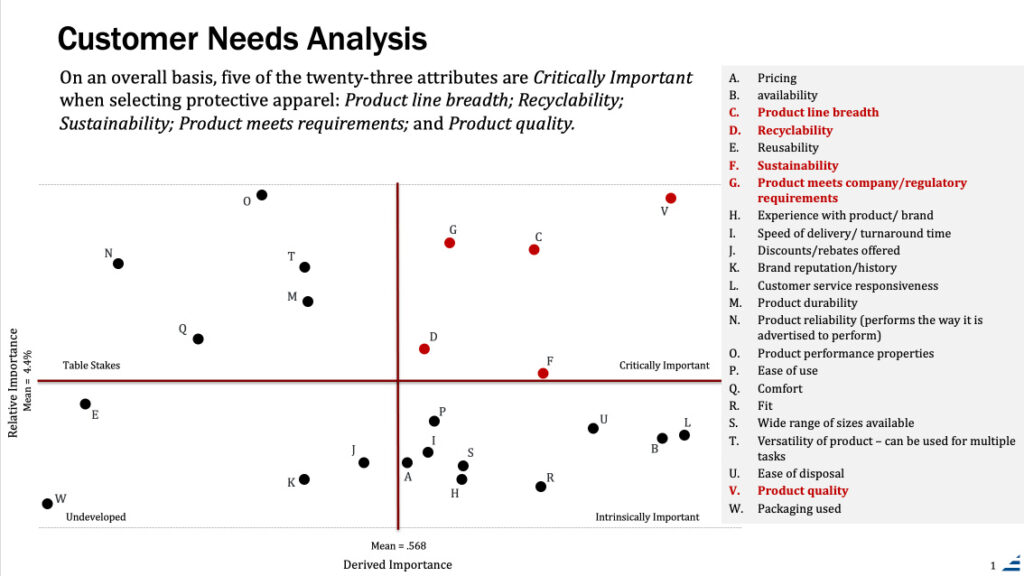

The data that is created in this multi-step process can then be plotted against the Customer Needs Matrix to visualize where key product attributes live.

You can see from the example above that once the attributes are plotted, conclusions become much more apparent and resulting actions become more obvious. How a brand responds to what the complete data reveals depends on the truths specific to each product or brand in a given market or category.

Can a Cup Holder Drive an Automobile Purchase Decision?

An often-cited example of the need for a more robust importance analysis comes from something you might not expect to be a driver of an automobile purchase—the seemingly unimportant cup holders in the center console!

When asking survey respondents to provide the criteria they use to choose which car to buy, you wouldn’t expect to find “the quality, number, and location of cupholders” to be very important…and typically you won’t.

However, once a customer purchases a vehicle (or any product or service), they start to familiarize themselves with the various product features they use every day. In this example, the driver finds that the placement, size, and ease of use of the cup holders becomes a source of frustration. Large mugs don’t fit, the elbow has no place to comfortably rest, reaching for a drink feels awkward and cumbersome. The customer then attributes that frustration or dissatisfaction to the car itself…perhaps even the brand. When making a future purchase (or determining whether to recommend their prior purchase to someone else), you better believe that cup holder dissatisfaction becomes an important criterion.

Still, a customer may never state this openly in a survey or customer feedback study, but that attribute exists, and the customer is deriving a tremendous amount of importance in their evaluation of their overall customer experience.

It’s these types of hidden insights and market preferences that can be uncovered and leveraged in a variety of ways—from product development and quality assurance to brand development and marketing messaging.

We’ll dive more deeply into acting on this clearer understanding of Key Purchase Criteria in a subsequent article; but some conclusions are beginning to reveal themselves…

- Perhaps a brand took stated importance as gospel and focused its strategy on what it presumed to be differentiating product attributes. In actuality, such attributes are considered “table stakes” by customers and merely gets them into the consideration set.

- Perhaps a brand has been unwittingly ignoring what is “intrinsically” important to the customer, and a messaging course change could help it differentiate by adding value to their customers.

- Perhaps a brand’s messaging was misaligned, not understanding how their product or service genuinely performs against how a customer or market authentically evaluates and expresses importance of attributes that generate satisfaction.

- Perhaps a brand performs well in attributes that aren’t fully developed (low stated and derived importance) but does so well that competitors are unable to compete on these attributes. This may create an opportunity for the brand to “move” that attribute into a different quadrant, allowing it to outperform the competition.

The insights that are revealed through Key Purchase Criteria analysis are powerful and potentially game-changing for companies. Once harnessed, they can influence or guide everything from product innovation and market diversification to customer service initiatives, customer experience optimization according to truly important drivers of satisfaction and loyalty, and more targeted and effective marketing and advertising campaigns.

If such studies are, in fact, novel to insights newcomers, or insightful to brand and product managers who simply strive to know what they don’t know, I would be happy to share this process with you in greater detail and discuss whether your company is truly hearing what your customer base is trying to tell you.

Ken Donaven serves as Senior Director with Martec. To get in touch, use the Contact Us form below.

Related reading: Benefit-Value Analysis: A Tool to Increase Market Share