While healthcare providers, telehealth companies, and insurers all try to discern their path forward in a post-pandemic landscape, our newly released study shows significant levels of consumer insecurity. Concerns have been identified for both in-person and remote care. Findings also draw a roadmap for healthcare providers looking to regain consumer trust and optimize capacity levels.

Prior to the COVID-19 pandemic, patients expressed extreme frustration with in-office appointment scheduling, wait times, and cost transparency. Addressing patient experience dissatisfaction with these items post-pandemic will continue to be critical to mitigate loss of patient visits and revenue. Successful providers will accelerate the redesign of the patient experience – for both in-person and remote visits – to deliver offerings that support convenience for the patient.

Our nationwide study with the healthcare marketing division of The Motion Agency documents that over half of consumers now have experienced a remote visit with a healthcare provider – up from 31% in February 2020. Among those who haven’t engaged in a virtual visit yet, a third say they’re highly likely to consider one.

>> Download our Reengaging Healthcare Systems Case Study.

Emotions Subconsciously Drive Healthcare Decisions

The study found that the largest percentage of both groups – 46% of telehealth users and 53% of those who have not used telehealth yet – are neutral about future engagement. They’re intrigued, but they need to be won over still. The apparent tradeoffs with remote versus in-person healthcare have yet to move the needle towards positive sentiment. Forty percent of respondents indicate missing the structure of in-person visits with physicians, while the lure of no wait times and easily getting appointments is welcome.

In the end, to succeed in getting more patients to return and continue utilizing healthcare services, providers need to customize their outreach to individual consumer segments. They also need to meet at the patient’s preferred form of reengagement. The study identified four unique consumer segments with significantly varying viewpoints on reengaging healthcare systems.

Meet the healthcare system reengagers

The Apprehensive Reengager

Primarily married, these 35- to 54-year-old suburbanites represent the lowest incidence of telehealth experience among the identified consumer segments, both prior to and during COVID-19, and the highest level of concern about being in a hospital or doctor’s office. They simultaneously express concern about the accuracy of telemedicine and skepticism about healthcare facilities’ sanitization and PPE protocols. They have comparable levels of anxiety with both remote and in-person visits. Reporting the biggest drop in mental and emotional health of any segment, a high percentage of “apprehensive reengagers” live in states with major COVID-19 restrictions. They are college educated with annual incomes ranging from $50,000 to $150,000.

The Concerned Reengager

The oldest (55+) group among the segments, these individuals predominately live in areas with low COVID-19 restrictions. They reported a low incidence of remote visit experience, both prior to and during COVID-19. Although expressing a high level of concern about being in a hospital or doctor’s office, they showed slightly more concern surrounding telehealth than in-person visits. Specifically, they view in-person doctor visits as more productive than remote visits and expressed anxiety about telehealth technology. “Concerned reengagers” have the lowest annual income (under $50,000) and education levels (high school or trade school) among the segments. They reported little change in overall mental or emotional health during the pandemic.

The Remote Reengager

These young (18- to 34-year-olds), largely single reengagers live in primarily urban and suburban areas with low COVID-19 restrictions. They indicated high adoption of telehealth services, both prior to and during the pandemic. While categorizing their concern about being in a hospital or physician’s office as low, they showed a significant difference between concern for in-person visits and confidence in telehealth. “Remote reengagers” view virtual healthcare as a safer option than an in-person appointment, at least until a working vaccine is widely available. They also like the freedom and control that a remote visit offers. They reported little change in their mental or emotional health during COVID-19. Their annual income ranges between $50,000 to $75,000, and they have a bachelor’s degree or high school education.

The Confident Reengager

These primarily urban 35- to 54-year-olds live in states with major COVID-19 restrictions and are confident in engaging with the healthcare system in-person and, even more so, remotely. Among all segments, they represent the highest incidence of telehealth experience, both before and during COVID-19. They also reported the lowest level of concern about being in a hospital or doctor’s office. They carry the lowest overall drop in mental and emotional health during the pandemic. Mostly married, “confident reengagers” enjoy the personal nature of in-person visits with their physicians while appreciating the convenience of telehealth. This group holds the highest levels of education and annual income ($75,000+).

Takeaways

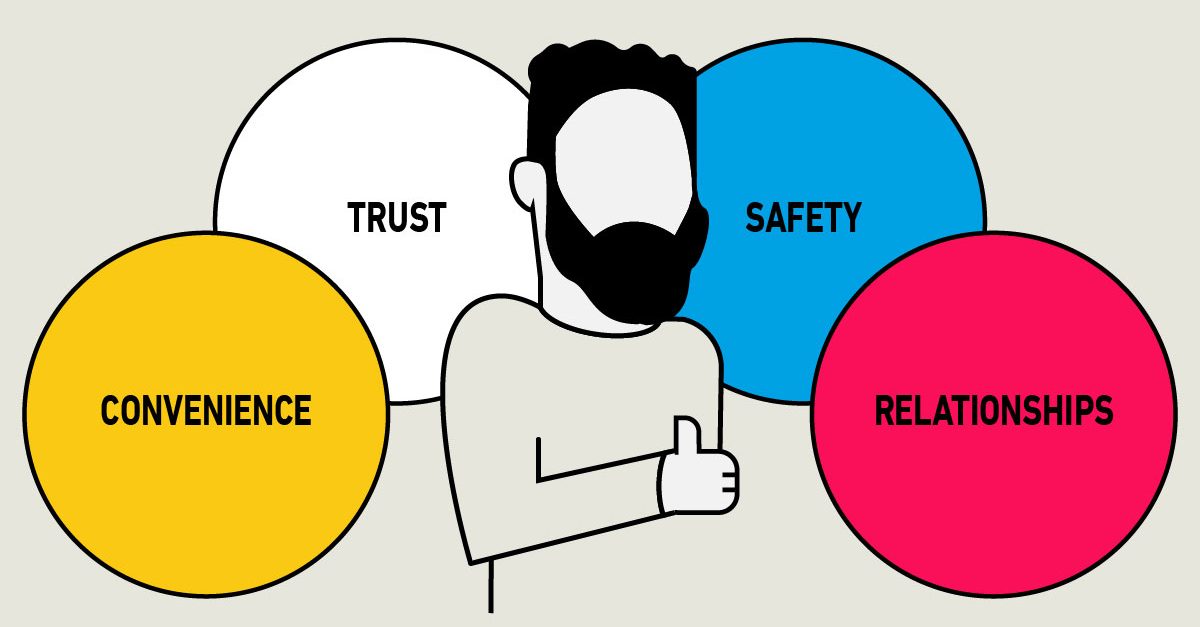

Four pivotal areas drive consumers’ emotions and decisions about reengaging with healthcare providers:

- Personal relationships – Feeling a strong connection to their physician

- Safety – Concerns exist for both in-person and telehealth care

- Trust – Perceived accuracy of diagnosis and treatment with telemedicine

- Convenience – No travel time

Providers should establish more frequent touch-points as they work through their patients’ insecurities about reengaging with healthcare systems. Addressing safety concerns about using emergency rooms and urgent care is particularly crucial, as study findings show consumers are especially reluctant to visit these facilities for fear of exposure to the virus.

As for remote healthcare, the rapid adoption of telehealth during the early stages of COVID-19 afforded no time to better educate consumers about how to use virtual care. Virtual health organizations need to:

- Review and support the customer journey

- Identify use cases for when virtual visits can provide a strong option over in-person visits

- Address consumers’ concerns about the privacy and security of their personal information

To build resilience, regain consumer trust, and optimize capacity levels, healthcare providers need to understand their community’s unique consumer segments and address each group accordingly.

Companies supporting this study

For more information on the study or to request full research findings, please contact us.

Related reading: Consumer Trends in Healthcare: What’s Being Adopted