“Blockchain technology represents the second generation of the internet.” – Alex Tapscott

While it seems everyone and their neighbor is now talking about blockchain and cryptocurrency, the underpinning technology or algorithm has been around for years. And, the truth is that very few people have a working understanding of the concept, let alone the implications for our industry. This post provides a high-level gloss on the subject.

What the heck is blockchain?

Let’s start the discussion with the basic building blocks behind the hype and then get to exploring the implications for you as a fellow researcher.

A full explanation of the technology and its details is far outside the scope of this short blog post, but we will cover enough to make you dangerous. The “textbook” definition: blockchain is a method of accounting for trades using a distributed account (or ledger). Transactions are accounted for by peers in a network. Because verifications are unanimously certified by the decentralized network there is no need for middlemen.

Here is an example that may resonate with many. Imagine George, Kramer, Jerry, Elaine, and Newman don’t have Venmo, PayPal or Snapcash … well they didn’t. A group like this will often cover the tab for one another and they can more or less settle up at the end of the month. To make sure everything is accounted for, the group will individually write down the trades they make to avoid any confusion and compare notes later (Newman is not to be trusted). The beauty is that any mistakes get picked up because enough people were diligent with their lists – “George bought a ‘Big Salad’ for Elaine on Monday for $8.” If someone screws up, say Kramer claims that providing mango slices makes up for all the food he has stolen over the years, that’s something that everyone will ‘catch’ when the lists are compared.

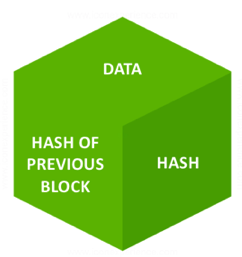

Blockchain works in much the same way. Consider the simplest element of a block chain. The most basic conceptual unit in the blockchain is a “block” consisting of three key elements:

Data: This could be any transaction, information or trade. (e.g. “Newman fronts $100 for gas to Kramer for their Michigan bottle return operation.”)

Hash: This is a unique identifier for the block like a fingerprint.

e.g. “Trade C” ![]()

Hash of previous block: This is the unique identifier for the previous block that completes the link in the chain (e.g. “Trade B”).

The only block that doesn’t have a previous hash included is the very first block in a block chain. This first block is called a Genesis Block.

In reality these identifiers and the data are often encrypted using long chains of numbers and letters. You can see in this picture the way the blocks form a chain of information similar to the lists/ledgers from my example.

The chains of blocks represent the history of trades which allows for verification. Each time a new transaction or block is produced each of the peers receives the new block which needs to be verified.

Each block is verified by the peers (nodes) in the network. This method is called ‘proof of stake’ with cryptocurrencies. The idea is that computing and certifying the validity of a block allows for the policing of the network without any outside governance. With Bitcoin and other cryptocurrencies, the calculations to verify the network are rewarded and considered “mining”. It is called mining because the speed, work and reward of regulating the network is similar to that of precious metal miners (e.g. gold, silver, copper, etc.).

What does blockchain mean for the future of Market Research?

This evolution could well be on the order and magnitude of the paradigm shift initiated by the manifold application of the internet to the market research industry. Many of our veteran staff recount the stark difference between practicing research in stacks of hard copy files, plentiful flights, and typewriters compared with the realities of big data, survey research, online file sharing, and bouillon web searching today. Sample gathering is far more efficient…

Total Access

As research and insights professionals we will gain an unprecedented level of access to a comprehensive view of consumer activities and behaviors. Blockchain based transaction data in various forms is likely to surface including the where, when, and who of trades we can only speculate on today. Presently phone and credit card companies have some of this information and they are capable of amazing insights as a result, even as they scratch the surface of the possibilities. The advance of blockchain technology has the potential to expose this level of information to everyone. Did I mention these data are immutable and quantifiable, verified by the entire peer network, distributed to avoid deletion, and coded carefully!

A lot of folks will throw the term 360 around where it doesn’t fit, but this type of cumulative profile triangulation makes the mark.

Data Surge

The other side of the coin (excuse the pun) is the sheer volume of this data which is likely to dwarf our concept of big data today. However intense the storage needs become our ability to leverage both artificial intelligence and human intelligence to properly and efficiently access the correct data will need to evolve significantly to access the value of this expanded data pool.

The End of the “Professional Participant”

We operate our own privately developed panels here at Martec and cooperate with great thoroughly vetted partners including OP4G and Quest Mindshare to access large sample pools. Despite all the most advanced screening, filtering, cross-checking, speed-trapping, straight-line monitoring, and longitudinal policing … the greatest enemy of valid survey data remains imposter, the cheater, the unqualified participant trying to make a buck without the necessary background to provide meaningful insights.

The ample and publically available firmographic data on potential panelists and survey participants will finally allow for a new level of screening that can eliminate those pesky folks trying to game the system and pretend to be someone else to make a buck on your survey.

Not to mention the time and planning savings involved when you can start off with a wealth of information on a research subject! The evidence collected on potential participants could completely eliminate the need for screeners and demographics questions. Blockchain verified behavioral information can tell us about people and researchers won’t need to trust their self-reporting.

A Cumulative Picture

As market research and insights organizations forge a path into the space this information will also be tied to the story of an individual. The participant profile builds like a snowball and their true self is more and more clearly triangulated with additional data. These profiles will be incredibly useful for retargeting in terms of marketing and research.

There are already firms building blockchain verified private profile platforms to that aggregate individuals’ data from around the web. The idea at this stage is protection and simplicity. A similar system could be the key to a more advanced panel experience.

I’m only in it for the incentives

There are many programs providing near valueless tokens in exchange for research participation (e.g. Swagbucks, Mintvine, etc.) and there are many new platforms offering near valueless quantities of cryptocurrency (e.g. Sweatcoin) in exchange for website stickiness, interest schemes, and so on.

The hype around the idea of cryptocurrency going up in value and the amazing flexibility of these currency types makes a perfect candidate for incentives. At the eighth plus decimal place, anyone can afford to ‘incentivize’ panelists!

Time for an Insights Coin?

Since the first public recognition of cryptocurrencies plans have been laid for multiple meta-blockchains to coordinate and validate existing blockchains. The next logical step for an industry built on seeking and understanding data is to get intimately involved with the transfer and availability of information. Imagine a coin based on the concept of sharing valid and appropriate information for noble uses such as meeting consumer needs. Such a coin could establish a secure and platform for trade that encourages more collaboration and builds additional value (or at least reveals more value) in our vocation.

A Whole Cloth Market Research Blockchain Solution/Platform

All the building blocks are in place to establish a (possibly Ethereum based) blockchain regulated data exchange that hosts and updates 360 profiles including firmographics and other important consumer dimensions while incentivizing research participation and providing representation of the extreme value offered by our industry with a Market Research/Consumer Insights ‘coin.’

Example consumer dimensions that could be easily made available for a large base that opts in:

- Common demographics – Geography, age, sex, language, race, height, weight, financial status, etc.

- Shopping habits – Stores visited, purchases with amounts …

- Emotional baseline

- History

- Education

- Industry Cues – skills, technologies used, titles …

- Retargeting advertisement data

- Contracts

- Ownership

- Medical records

No one can quantify or estimate the true nature of the impact this technology or the coins it has initiated will have on our industry but many in the finance industry are bullish and excited about the future. I hope this has been informative and will give you a platform for innovation.