Recent global events have overturned the way we live, manufacture, and consume in an extraordinary way. One of the least expected and most spectacular of these changes on an industrial level concerns the future of hydrogen fuel cells. Within the automotive sector, attitudes towards hydrogen fuel cell powertrains have shifted. Interest in fuel cell technology is rising globally, and European policymakers and automotive manufacturers are helping to jump-start the decade of hydrogen.

At the beginning of 2020 – before the COVID-19 outbreak, when we at Martec conducted our first study of the year on the expected rollout of fuel cell stacks and systems among car and truck manufacturers – opinions were conservatively optimistic. Comments we gathered from automotive original equipment manufacturers (OEMs) were as follows:

“The penetration of fuel cell within the light duty segment, but mostly heavy duty, will be enormous. However, the market is not there yet – and it will not be there until the government actually invests in hydrogen refueling infrastructure. I believe that in 10-15 years from now, there will be a significant increase in number of hydrogen vehicles.”

“Fuel cell is nothing new; the technology is basically ready and available – but the market is not ready for it. There is interest, yes, for various reasons, but I do not foresee global light duty production volumes to exceed 500,000 units in 2030.”

The future of hydrogen fuel cells

There were the reasons why our respondents could not be more enthusiastic, or more precise. Two main obstacles have been constraining the fuel cell value chain:

- High costs of hydrogen fuel cell powertrain systems

- Weak hydrogen refueling infrastructure

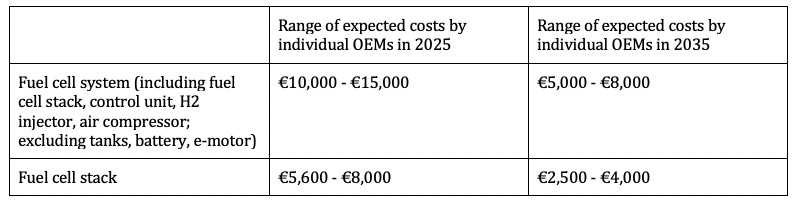

The cost of a hydrogen fuel cell powertrain system currently represents a major barrier to adoption. It is significantly higher than a battery electric vehicle powertrain. The fuel cell stack, which is the heart of the hydrogen fuel cell powertrain, equates for about half the cost of the system.

How much will a hydrogen fuel cell powertrain cost as production volume scales?

Several European OEMs we interviewed at the beginning of the year made the following cost forecast based on expected volumes in 2025 and 2035:

In addition to cost, a lack of political willingness to push the technology and related infrastructure also was a concern for automotive manufacturers.

There was interest in developing the fuel cell market in 2017-2019 in Western Europe and Asia, with several OEMs making moves. However, these barriers remained stamped in bright red letters in the mind of any decision maker or market analyst trying to build a market projection.

Jump-starting the decade of hydrogen

What has led to the sudden shift in attitudes towards scaling hydrogen fuel cell technology? A global pandemic followed by major economic shock has led European policymakers, notably in Germany and France, to make swift moves and support fuel cell technology. After all, it is not only cleaner than other automotive powertrains available, its rollout also ensures the preservation and creation of thousands of fuel cell jobs in Europe.

So, what does this long-awaited impulse for hydrogen mean for the fuel cell value chain? Where will national, European, and OEM investments go? Will the market and the infrastructure – finally – be ready? If so, when? In terms of components, who will manufacture parts; who will buy parts; who will watch and wait? Which companies will emerge as leaders within the fuel cell market; which countries will lead the way?

At Martec, we do not have a crystal ball that can answer these questions. What we do is ask people who are leading the way. We ask questions like: “What will it look like in 2021? What about in 2025? And in 2035?” We are constantly in touch with manufacturers, suppliers, and institutions to provide the necessary insights to power your fuel cell decisions. We have decades of experience in alternative powertrains and have made fuel cell technology one of our specialties.

Ready to start your next automotive market research study? Contact us.