Why Nuanced Analysis is Key for Manufacturing’s Return or Relocation

By John Lorinskas

In recent years, discussions around reshoring manufacturing — bringing production back to the United States or other near-domestic locations — have taken center stage. In fact, our own company president Rick Claar examined this evolving trend last year, and the picture continues to come into clearer focus as time goes on and more distance is put between the present and the pandemic.

Volatility continues to be the order of the day, however, and unpredictability right along with it. Since 2020, the COVID-19 pandemic, international trade tensions, supply shortages, global unrest, and climate-related disruptions have all conspired to give companies good reason to rethink their supply chains. Yet, while reshoring often presents opportunities for greater supply chain security, it requires a deeply granular approach to decision-making, accounting for regional nuances, industry-specific risks, and a shifting global landscape.

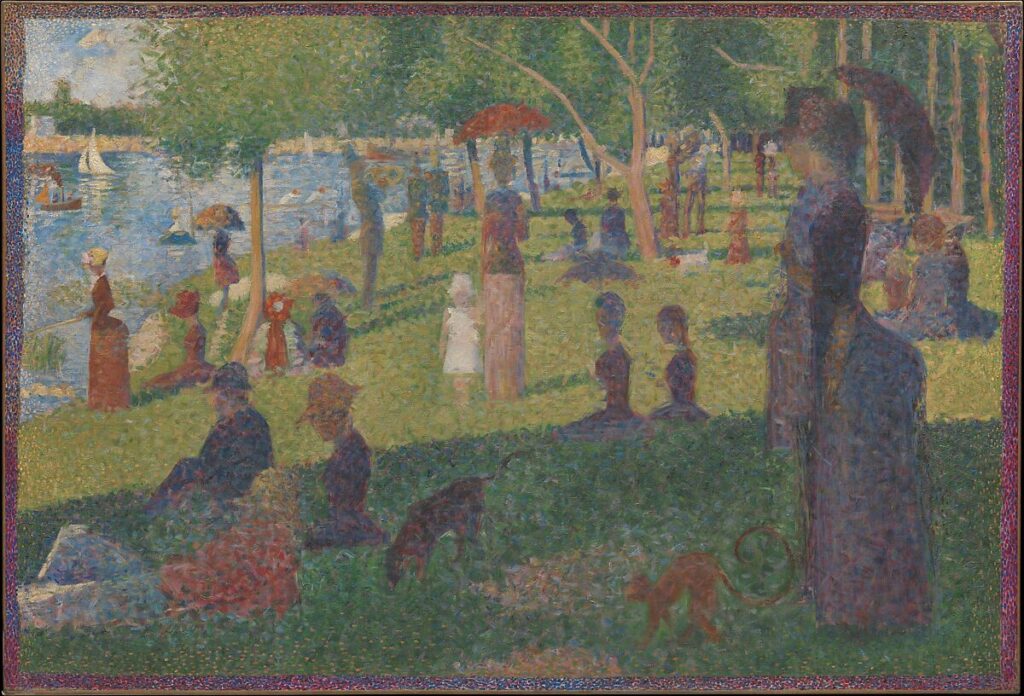

Like a painting by Georges Seurat, what looks clear from afar can begin to reveal something altogether different the closer you look. So it goes for companies assessing when, where and whether to reshore or relocate their manufacturing supply chain to inject greater reliability, security and predictability.

Let’s take that closer look.

The Rise of Reshoring Pressures

The shift toward reshoring accelerated, in part, under increasing discussion of proposed tariffs on Chinese goods, which revealed the risks for companies heavily dependent on Chinese manufacturing. Businesses with too little diversification in their supply chains faced the prospect of soaring costs and a sudden need to diversify sources.

With the pandemic, these concerns intensified as supply chain disruptions exposed the vulnerabilities of an interdependent system. Logistics costs surged, with the price of container shipping from China to the United States spiking to $35,000-$40,000 per container (from a prior average of $7,000-$8,000). Such unpredictable volatility in production costs led many companies to reconsider sourcing strategies, amplifying reshoring considerations.

While moving to nearby manufacturing zones in southeast Asia was an option, in many cases this would still not fully divest a company’s supply chain from Chinese manufacturing. Input components would still be required from mainland China, or to be shipped at a higher logistical cost from a non-tariff manufacturing region, increasing cost in either case.

Further obfuscating matters, Chinese companies began to purchase or establish joint-venture manufacturing sites in southeast Asia as well, in an attempt to evade tariffs. Components under tariff regime could have their subcomponents shipped to Vietnam, for example, and have the “final screw turned” there to claim the product was Vietnamese-made. The efficacy of these approaches was complex, but the result for the U.S. sourcer was to create a very confusing picture as to what, and with whom, they would be dealing if they tried to simply move their supply chain “next door.”

A closer look would be required yet again.

The Regionalized Reality of Supply Chains

Though reshoring has become a strategic objective for some, the path to implementation isn’t straightforward. Simply shifting production to the United States isn’t a universal solution; success hinges on a careful evaluation of geographic regions within the country.

For example, the Gulf Coast near Houston is a hub for chemical manufacturing, offering proximity to raw material sources like oil and gas. However, this region’s susceptibility to hurricanes and extreme weather events creates unique risks for supply stability. For this region in particular, “the hits just kept on coming,” as they say:

The Texas freeze and the power outages brought the world’s largest petrochemical complex to a standstill, forcing more plants in the Gulf of Mexico region to shut down than during Hurricane Harvey in 2017. A month later (March), many remained offline, and analysts said it could be months more before all are fully back. Prices for polyethylene, polypropylene and other chemical compounds used to make auto parts, computers, and a vast array of plastic products, have reached their highest levels in years in the U.S. as supplies tighten. For example, prices for polyvinyl chloride, or PVC, have more than doubled since last summer, according to S&P Global Platts. The shortages in PVC and other materials are even shutting down automotive production lines, as well as other manufacturers that I’ve been speaking with.

Companies producing temperature-sensitive materials, such as pharmaceuticals or electronic components, must now increasingly consider these factors before settling on a location. What once seemed like an intuitive regional selection now bears greater scrutiny and deeper due diligence than ever before.

COVID-19 and subsequent climate events showed the cascading effects of disruptions at major ports. Texas’s power grid failures during winter storms impacted not only the port’s functioning but also supply lines for numerous industries dependent on Houston’s petrochemical outputs.

Temperature-sensitive goods often require specific port facilities, and backups at these critical logistics points ripple throughout the continent. Just as critical is the port’s infrastructure and specialization, which may impact its suitability for different types of goods, such as pharmaceuticals requiring cold storage or machinery that needs protective casings.

The Subtle Yet Powerful Role of Validation and Compliance

In many manufacturing industries, switching suppliers is not a simple matter of choosing a similar product. Complex regulatory processes often mean that substituting materials — such as polycarbonate resins for automotive headlights or protective barriers — requires exhaustive validation and compliance checks. This process can take months or even years, and in industries like automotive, where each part plays a role in the safety of the end product, there is little flexibility for rapid adjustments.

This makes strategic reshoring decisions, coupled with diversification of validated suppliers, vital to maintaining continuity in production. Again, a closer look.

Industry-Specific Nuances in Reshoring Decisions

Different industries have distinct reshoring considerations. Electronics manufacturers, for instance, may look toward Vietnam, Thailand, or Malaysia for certain types of labor-intensive assembly, depending on the skill level required. However, electronics companies sourcing precise, high-quality components may find domestic reshoring beneficial, provided they can address the complexities of locating skilled labor or the right materials in specific regions of the U.S.

Similar trends are evident in the pharmaceutical industry, where regulatory burdens and cold-chain requirements place unique demands on the supply chain infrastructure.

Evaluating Reshoring: A Comprehensive Approach to Decision-Making

For businesses assessing reshoring, understanding both high-level trends and granular specifics is crucial. Some key areas to investigate include:

- Supply Chain Geography: Companies must evaluate the region’s proximity to raw materials, manufacturing competencies, and natural disaster vulnerabilities. A balanced view between logistical convenience and environmental risk is essential.

- Alternative Sourcing: Even as some businesses move away from China, they may shift operations to countries like Vietnam or Thailand, where Chinese manufacturers have established plants. This “outsourcing reshoring” presents different risk profiles and operational dynamics.

- Port Infrastructure and Reliability: Ensuring a region’s logistics hubs can handle necessary goods is essential. Industries with specific requirements, like refrigerated storage, must assess whether a region’s ports are equipped to handle temperature-controlled goods or other specialized needs.

- Cost-Benefit and Compliance Analysis: For each location, businesses need to compare the costs of reshoring with potential gains in supply chain stability, factoring in the cost and time required for regulatory approvals and compliance processes.

- Regional Competence and Workforce Availability: While some regions excel in high-skill manufacturing, others may lack the specific competencies required, making them less suitable for more complex manufacturing tasks.

- Customer and Competitor Intelligence: It must not be overlooked how important it is to understand the regional nuance that reshoring brings to the cost-benefit analysis. What are your competitors doing, and how is the market responding? There may be a benefit, for example, to boast “Made in America;” but will the market bear the additional cost that such a reality may necessitate?

Insights Into Intelligence. Intelligence Into Confidence.

The decision to reshore involves more than a simple assessment of costs and logistics; it requires a nuanced understanding of regional capabilities, risks and the intricacies of each supply chain segment. Companies must take a holistic approach, recognizing that success in reshoring depends on selecting locations not just by their national or geographic advantages, but also by their unique attributes within specific industries.

In this regard, the value of sophisticated and deep qualitative research cannot be overstated. Gaining the insider insights of industry experts and hyperlocal players “on the ground” is critical to seeing all of the relevant data points that reveal the data-backed truth.

Reshoring, ultimately, is not just about bringing production closer to home; it’s about constructing resilient, adaptable and secure supply chains for an unpredictable future. It’s both looking at the big picture and the minutiae of the granular details that reveal the true picture of reality. Just like a painting by Georges Seurat painting.

John Lorinskas serves as project manager for Martec. Contact him at [email protected] for questions about reshoring research or any of the disciplines referenced throughout this article.