Insights Sought

A leading industrial consumables manufacturer embarked on a comprehensive research initiative to gain a deeper understanding of the voices of its customers, including both sales reps and end-use customers. The insights captured varied by customer cohort, but provided a comprehensive view of awareness, perceptions and other metrics used to develop key brand mapping insights.

- Brand awareness, familiarity and usage

- Product usage (types of consumables used)

- Key Purchase Criteria (product)

- Key Purchase Criteria (brand)

- Purchase decision processes and influencers

- Brand/product satisfaction

- Challenges and pain points

- Brand Mapping insights based on value proposition perceptions

This endeavor utilized a qual-quant-qual methodology, combining qualitative insights from in-depth interviews, quantitative data from extensive surveys, and additional qualitative analysis to refine, validate and provide additional context to the quantitative insights.

The primary goal of this research was to determine the key factors influencing purchase decisions for medium and large manufacturers, identify potential bottlenecks to the sales process, and enhance overall customer satisfaction and loyalty. By leveraging this robust research approach, the manufacturer aimed to optimize its distribution strategies and better align its offerings with the needs and preferences of its end-user customers—driving a+10% growth gap between its distributors and the overall market.

Robust Data: Qual-Quant-Qual Methodology

As explored in depth here, a qual-quant-qual methodology combines the color of qualitative research with the in-depth findings of quantitative research to provide deeper insights and richer context to our clients.

The methodology involves three phases:

- Qualitative | Design + Discover: Conduct initial qualitative research to understand unknowns and validate assumptions, ensuring the survey captures the true voice of the customer

- Quantitative | Read + React: Finalize and deploy the survey, emphasizing data integrity and combining AI with human intelligence for quality data

- Qualitative | Sharpen + Activate: Conduct additional qualitative research to delve deeper into survey findings and understand motivations behind responses

This methodology has proven beneficial for our clients across industries for many reasons:

- Richer Context: Qualitative phases provide context behind quantitative data

- Improved Survey Design: Initial qualitative phase identifies and addresses potential blind spots

- Actionable Intelligence: Final qualitative phase turns survey results into strategic actions

Results Delivered

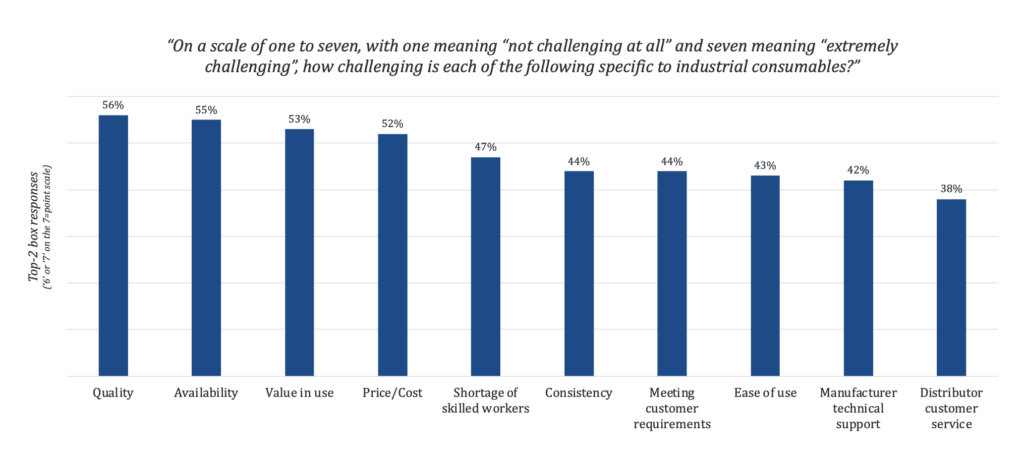

A core objective of this research was to identify the pain points users have with currently available products. By performing qualitative research prior to the online survey, we captured preliminary insights as to which pain points to measure in the quantitative phase and helped our client develop working hypotheses.

This approach effectively highlights the importance of quality and availability to enable our client to align their offerings to meet customer needs. Additionally, part of this objective was to gain a deeper understanding of brand impact and selection. Although our client’s brand was not recognized as the market leader, the research identified our client as the thought leader in the industry according to users across the pyramid and distributors.

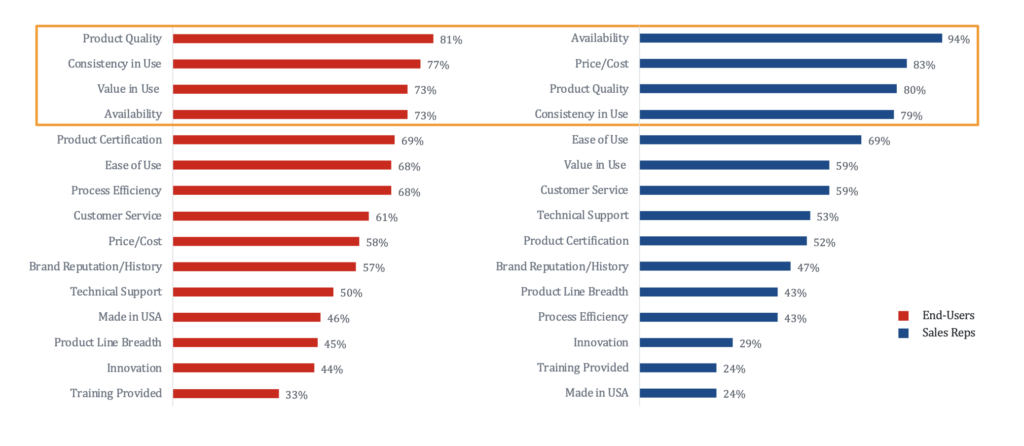

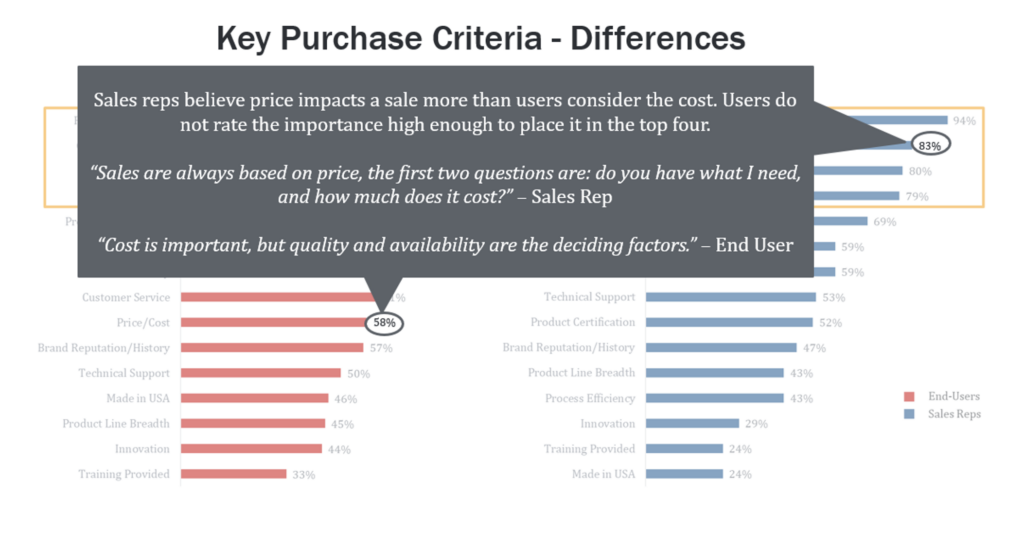

In addition, key purchase criteria (KPC) were identified for both end-users and sales representatives. By comparing KPCs between end-users and sales representatives, we were able to provide a clear understanding of both the similarities and differences across these key constituencies. While Product Quality, Availability and Value in Use were consistently in the top four most important attributes…

…Price/Cost was significantly less important to end-user customers than to the sales reps. Identifying this disconnect provided valuable insights for our client, as it allowed them to focus sales rep messaging on core elements of the value proposition and reduce reliance on price-focused messages.

The Conclusion

At the completion of the final qualitative interviews, a clear direction was identified to enhance the client’s market position. This included increasing brand awareness through targeted marketing efforts via appropriate marketing channels; increased communication around the value of the products among the sales team (to de-emphasize the focus on price); and improved sales rep/distributor training on the industrial consumables, to reduce their focus on equipment sales.

Action Taken

Our client achieved significant revenue improvements and channel coverage. Initially, the organization had focused on its largest customers and had expended far fewer resources on mid-sized and small customers (who primarily purchase through distributors). However, the insights captured in this comprehensive effort persuaded our client to shift its strategy.

Based on these insights, our client moved from a mostly direct sales/large customer strategy to a hybrid direct-sales vs. distribution sales strategy. This strategy included expanded training to select distributors and investments in two large training centers. Our client also focused on key performance and value attributes, both for its highest value products and adjacent products, to build brand and portfolio awareness.

As a result, our client saw a +10% growth gap between its distributors and the overall market. While distributors declined last year, our client’s core distribution partners experienced growth in this key industrial consumables category.

“Martec helped us identify deficiencies in our sales approach and our messaging. While we may not be the biggest player in this market, this research helped to confirm that we are a thought leader, which allowed us to improve our messaging and shift our channel strategy. We have successfully focused on key performance and value attributes and improved both brand and portfolio awareness.”

— Commercial Director, Industrial Consumables Manufacturer

Your Customers

Do you need help understanding your customers and improving your market position? Let’s have a conversation about what you need to know and how Martec can help answer questions about your customers and channel partners.

Contacts:

The Martec Group

Ken Donaven – Partner

[email protected]

Chelsea May – Project Manager

[email protected]