Goby and Martec partner to advance ESG due diligence solutions for private equity firms

The Martec Group, a global market research and consulting firm, recently partnered with Goby, The ESG Platform, to study and advance ESG (Environmental, Social, Governance) solutions for private equity (PE) firms.

In a recent study conducted by Martec and Goby, one respondent said:

“To stay competitive these days, you have to be serious about ESG regardless of your size. It’s impacting smaller firms and not just PE. Hedge funds are seeing the same pressure from LPs [limited partners].”

ESG progress and outlook

The overall outlook is very positive for ESG-related solutions as general interest in ESG goals and data has spiked in the past 12 – 18 months and is not expected to slow. Further, management solutions, specifically ESG software, have been experiencing significant demand in the PE space over the past 12 months. Expectations are that the recent spike in demand will continue to accelerate and expand as LPs focus on ESG and other similar initiatives.

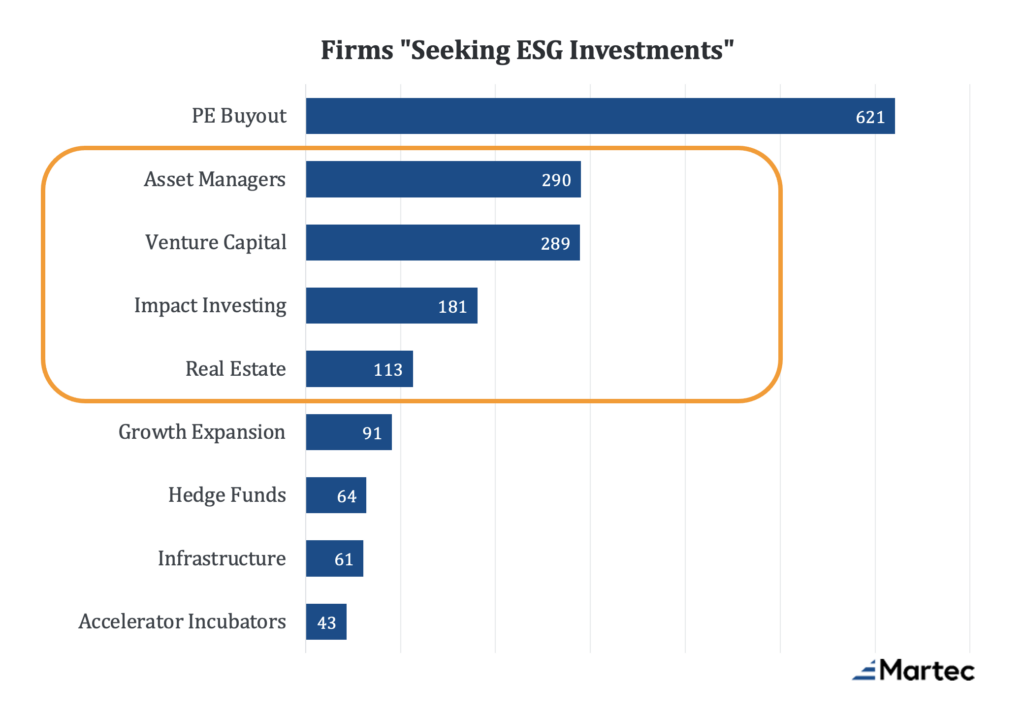

The number of firms seeking ESG investments is vast

The macro-overview of the market indicates a high likelihood of success for companies advancing ESG solutions, in particular software solutions.

For example, a recent search in the PitchBook database yielded ~2,000 firms that state they are “seeking ESG investments.” This includes PE buyout, asset managers, venture capital, impact investing, and real estate firms leading the way.

What’s driving middle market ESG due diligence

Capital Sources – public-facing LPs are requesting ESG information, including government agencies, public pensions, banks, and insurance companies.

- These businesses typically send questionnaires for general partners (GPs) to fill out

- PE firms repeatedly point to LPs as the primary drivers for increasing ESG initiatives

- In our research, the two most frequently mentioned types include pension funds and endowments

Geographical Focus – the EU is far ahead of the US in terms of ESG and likely to enact more regulations that will drive issues even further.

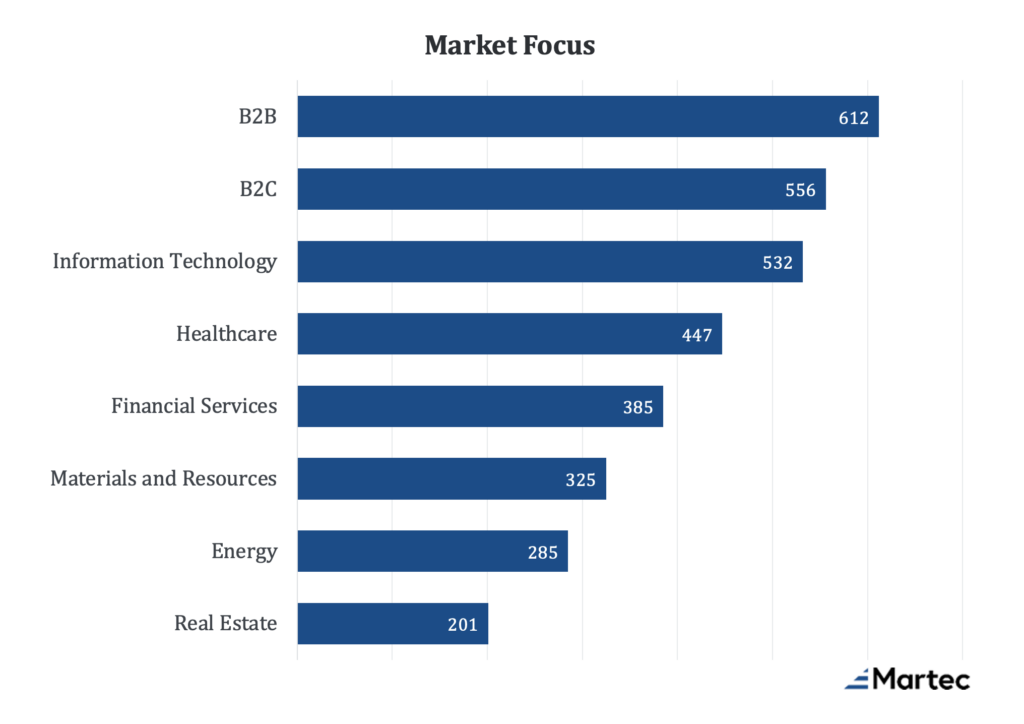

Market Focus – environmental issues have been taken into consideration for many years for deals that focus on environmentally sensitive markets (e.g., oil & gas).

- Societal and governance issues are increasingly important for specific sectors (e.g., services and labor-intensive markets)

- B2B, B2C, and information technology (IT) companies are showing the highest levels of interest in ESG solutions

Regarding market focus, it’s important to know what investors have in place so that a firm can better report disclosures. If investors in the market follow CDP guidance, chances are climate risk and carbon emissions are very material to the industry and that might be something to investigate. Similarly, in the real estate market, GRESB might be the right framework to use. Goby and Martec consultants can help PE firms gain a better understanding of which frameworks are predominantly used in the industry.

Other key areas of focus impacting interest in ESG solutions are fund size and investment philosophy. A firm’s investment philosophy can play a key role as motivation levels are changing across the ecosystem.

Middle market firms (companies with annual revenues between $500 million – $2 billion) may benefit most from ESG software solutions. These firms have seen the most dramatic change to their process and an intensifying need for ESG management solutions. Organizing sustainability initiatives and ESG data with a cloud-based solution, like Goby, could work well for firms in this space.

Lower middle market firms are next

Lower middle market firms (companies with annual revenues under $500 million) see a less urgent need to implement ESG initiatives. However, respondents in this group believe the importance of ESG will increase in the next 3 to 5 years. One respondent said:

“[There is] a lot more talk in the media than in boardrooms currently. But this is growing in importance, and we’re definitely talking more about ESG before, during, and after deals.”

Expect to see more Social Sustainability and Sustainable Governance

Growth can be more about the “S&G” (social, governance) than the “E” (environmental) for PE firms.

- EH&S (environment, health, and safety) has been a focal point for many years

- S&G is growing due to cultural shifts, increasing investment in human capital businesses, and more socially responsible investing and impact investing

Goby and Martec study findings point toward the bulk of ESG growth in PE being S&G focused – with diversity, equity, and inclusion (DE&I) initiatives.

Regardless of where a firm may be today, ESG due diligence is growing in importance. Goby and Martec can help middle market private equity firms complete ESG due diligence.

View The imperative for incorporating ESG into the due diligence process on-demand webinar recording where Goby and Martec reviewed the results of this research as well as best practices and trends.