Key takeaways from the Quirk’s Virtual Global Event

The Quirk’s Virtual Global Event curated a valuable collection of sessions with leaders in the insights field. Several industry trends, including the future of marketing research, were covered. The trend of market research agility continues to blossom as our world becomes more connected through technology. Market research agility refers to the ability of an organization to make sense of the market and execute a strategic business decision swiftly.

Two sessions expertly spoke to this trend:

- “Quick vs. complete: Balancing speed and depth in consumer research,” presented by Liberty Mutual

- “Just how Bad are Long Surveys, really? A Measurement of Data Degradation due to Length of Interview,” presented by Quest Mindshare

Quick vs. Complete

In Liberty Mutual’s presentation, a leading business analyst shared techniques on how to deal with the growing need for more rapid marketing responses and how to streamline the process.

Consumer sentiment is changing at a faster pace as the world becomes more interconnected. This faster pace requires brands to streamline their processes in order to respond appropriately to consumer sentiment.

In the presentation, it was stated that brands are now faced with a dilemma: How to determine the correct course of action in a short amount of time?

The solution: By planning for the unexpected.

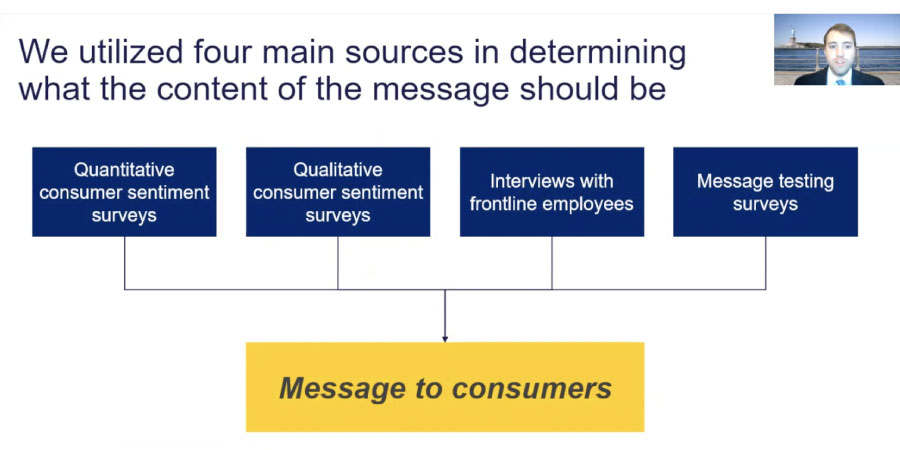

Brands must have both testing and data interpretation plans set up in advance. Liberty Mutual relies upon four main sources to gather data quickly:

The key takeaway from this session is that quick responses to changes in consumer sentiment are possible through reliance on data. Themes can be developed from data. Then testing marketing responses from each of the top themes with a diverse audience will show decision makers a clear path forward.

One video shared during the presentation drove home the concept of testing with a diverse audience. Test to make sure your brand’s messaging resonates positively — not negatively. (Pepsi Commercial – SNL: https://www.youtube.com/watch?v=Pn8pwoNWseM)

Another helpful reminder is to steer clear of analysis paralysis. Bottlenecks can occur when deliberating over multiple variables. Best advice: “Don’t let ‘perfect’ be the enemy of ‘good’” when a quick response is needed.

LOI and Data Degradation

Quest Mindshare, a leading provider of B2B and consumer market research online panel solutions, took a first step to answer: How long is too long for a survey?

It’s a well-known fact that longer surveys affect response rates, respondent engagement, and data quality. But by how much? What happens when the length of the interview or survey goes from five to 10 to 15 minutes…and beyond? Quest explored quantifying the effects of increasing the length of interview (LOI) by conducting their own research.

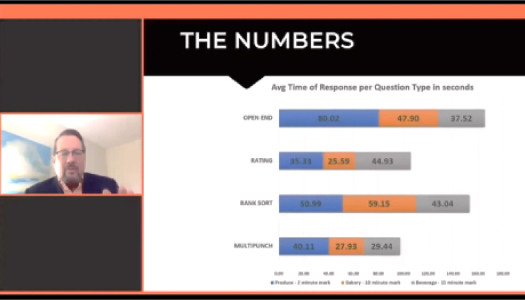

Regarding the respondent experience, where does a fall-off occur for a “longer” typical quantitative survey? To answer this question, Quest created a 20-minute quantitative survey to measure where data degradation begins. Their team reviewed the quality of responses at two, 10, and 15 minutes.

They found that increasing LOI can have measurable effects for survey results, decreasing engagement and reliability in specific ways. The time spent answering the same key four questions was about three and a half minutes at the beginning of the survey. Just under two minutes at the halfway mark. And, about two minutes near the end of the survey.

A minute and a half less to respond to the same questions for a different (but well-known) variable is significant. In this case, the survey questions were about grocery shopping and the variables were the different departments in a typical grocery store. The response times illustrate that respondents were thoughtful about their first set of responses and less so as the survey began exceeding the 10-minute mark.

Helpful tip: “Critically evaluate your survey length… [In this case] the longer survey suffered some attention lack.”

Another takeaway from the session was that open-ended questions near the end of the survey took quite a hit as well. For example, if it takes at least 10 minutes to answer eight questions thoughtfully… keep questions near the end simple if you design a 20-minute (or longer) survey.

How can you keep your surveys simple? Consider sentence length – keep the word count short (no more than 20 words per sentence). Also review word length – use simple words. Words that contain a lot of syllables are harder to read than words that use fewer syllables. For example, “It would be an indulgent purchase for me” is more difficult to read than “I would pay more for it.”

Other options to consider when you’re seeking quality responses for longer surveys are:

- Get respondents who are interested in the survey topic

- Design an engaging survey

- Compensate interviewees for their time and responses

In short, the future of marketing research is evolving rapidly. Being prepared to make strategic business decisions quickly, staying attuned to consumer sentiment, and reviewing the respondent experience are critical. Market research agility is not simply an industry trend, but a tactic for increasing share.

Related reading: Tips for Writing Market Research Survey Questions