One of the most common metaphors used to describe the relevance of market risk to commercial due diligence comes from the old adage: a rising tide lifts all boats. Regardless of a company’s attractiveness—its products, customer base, or operational sophistication—if the overall market is shrinking, even the best-managed business will face headwinds. Conversely, a strong, expanding market can often help cover for operational shortcomings, at least in the near term.

That is why understanding market dynamics is foundational in commercial due diligence. Getting clarity on market size, growth trajectory, and underlying demand drivers is critical to mitigating deal risk, forecasting realistic growth, and shaping appropriate investment strategies. Evaluating and upgrading the capabilities of the “ship” (the target company) is one thing; understanding the “waves” (market forces) it must navigate is another.

Market analysis remains the most requested module of commercial due diligence for private equity investors. The right approach provides far more than a sizing exercise — it creates transparency, accuracy, and confidence for investment committees.

Confidence and Clarity Through Triangulation

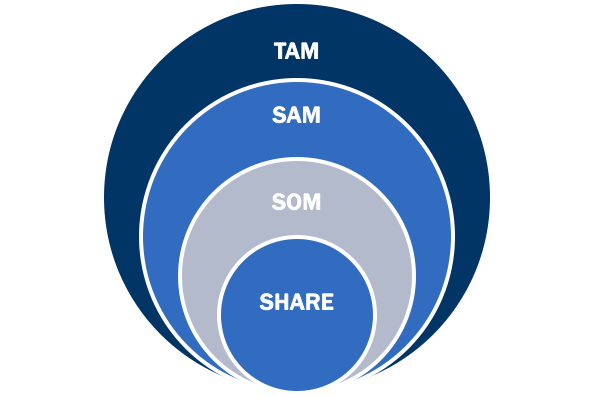

Most investors are familiar with the common approaches to getting an early feel for the size of the market by estimating Top Down, Bottom Up, or Hybrid. In the diligence phase a hybrid approach with multiple validated sources of truth is the most reliable method to build an accurate and actionable model for the market that includes the target’s TAM, SAM, SOM, Market Share, Forecast Scenarios, and an intelligent break down of these volume and value outcomes by relevant splits such as core solution segments, end-markets/verticals, geographic territories, etc.

Investors who understand the role and appropriate application of research and strategic consulting in the deal process are well positioned to maximize ROI and minimize otherwise undiscovered risks. Martec’s unique Triangulation approach to quantifying and qualifying Total Available Market (TAM) analyses has repeatedly provided an antidote that brings clarity and confidence to otherwise unclear or unknown investment dynamics. The team focuses on bringing the client/investor with them through the logical flow of the model from sources and confidence to drivers and moderators of each scenario. This level of transparency provides a meaningful and reliable view of the results.

Sometimes conducted as one module among a broader Commercial Due Diligence project, TAM Analysis is the first layer to understanding overall market opportunity and includes Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM), with a target’s actual market share at the core of understanding potential upside.

Defining the Solution and Scope

One of the first steps in the somewhat creative process of developing potential approaches to frame up the market is to clarify the definition, nature, and specs/parameters of the solution or solutions (product, service, offering) to study. It is common to find articles, studies, and software results that missed this step or that choose a broad proxy for a solution area in the name of convenience.

To truly understand how each layer of the market may or may not impact the target company, a market analysis needs to be founded with clarity as to which elements of the portfolio will be included. In many cases a model will be built for the core offering of the firm while a model is built simultaneously to address the growth potential of the firm with an added service area – for example, a strategist may quantify the market in, say, a three-state region to represent the core business of a potential acquisition while also modeling the size and feasibility of the same firm expanding their offering to include a seemingly market-adjacent solution for the same geography.

Coordinating with management and understanding product/service details from sales and marketing materials will provide the parameters necessary to understand which in-kind solutions should be considered in sizing the new market. Once the solution (and related SKU/SKUs) are dialed in, it is time to lock-in the scope of the sizing exercise to make sure all the stakeholders are on the same page when it comes to the included use-cases, buyer types, and geographies.

The next step to build a logical modeling approach is to ground yourself in a deep and accurate understanding of the subject matter. Let’s take a real-world example to illustrate…

Case in Point: TAM and Tires

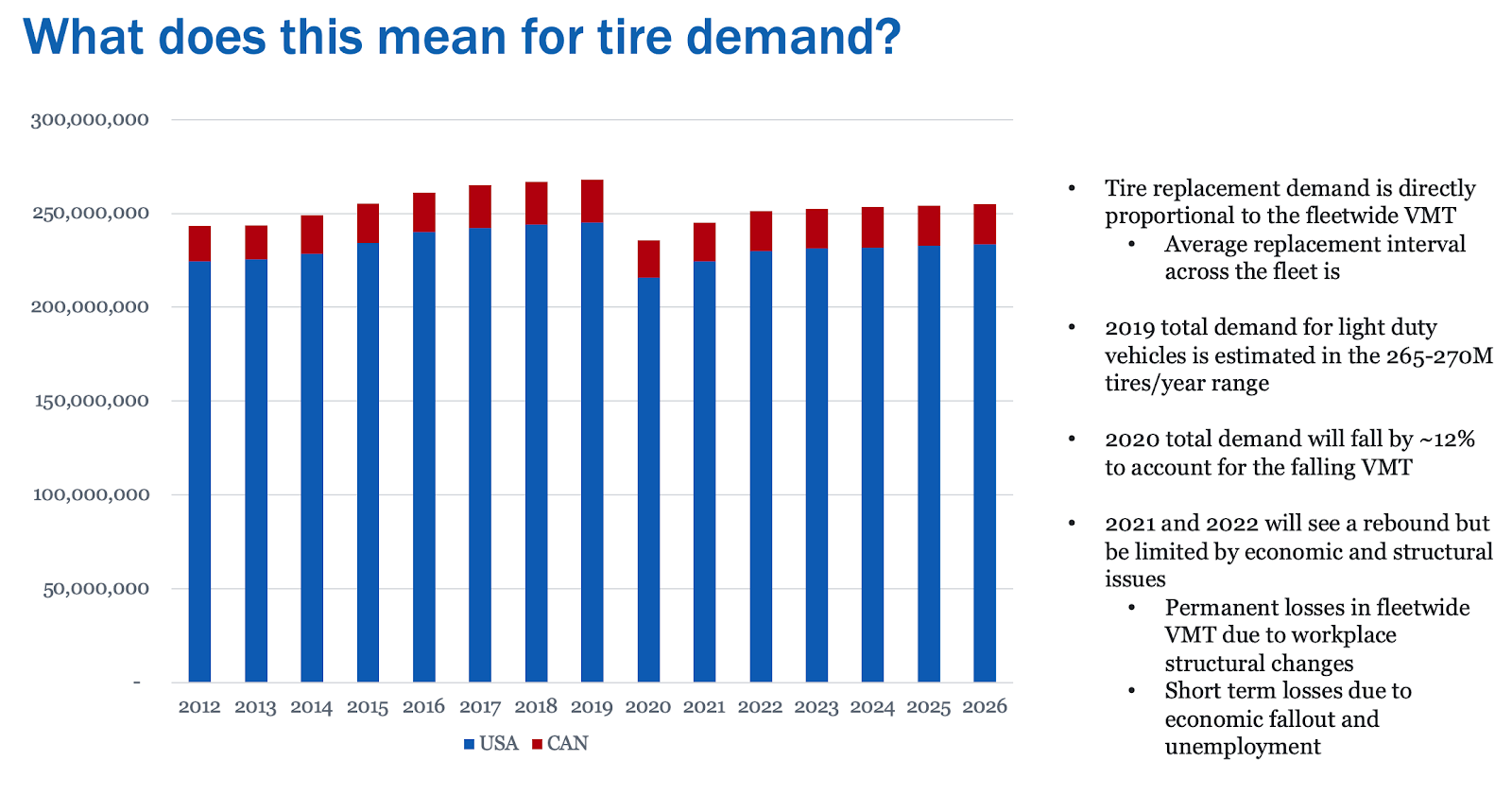

A practical example of how nuanced market intelligence can make or break a diligence process comes from Martec’s work with one of the largest tire recyclers in the U.S.

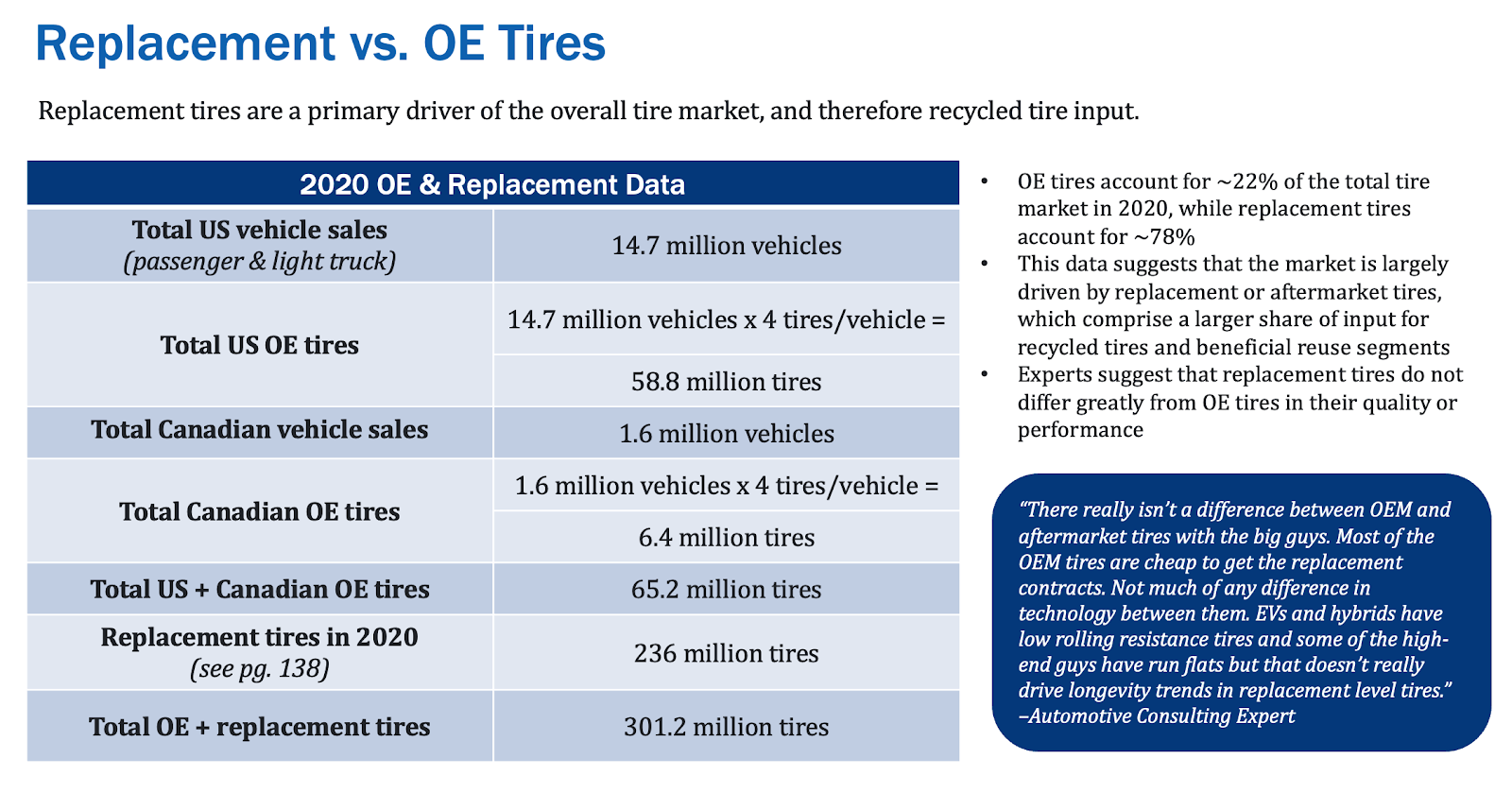

At the time of the engagement (2021), the company was being marketed for sale by its private equity sponsor, and the diligence was shaped by pandemic recovery. Vehicle miles traveled—a primary driver of tire wear—had dropped sharply in 2020. Understanding how quickly those miles (and thus replacement cycles) would return to pre-COVID levels was central to forecasting demand.

Unlike industries with stable inputs, tire recycling presented an unusually fragmented and volatile supply picture. Tires had to be sourced through a patchwork of contracts with dealerships, tire shops, and collection networks, each operating under different state-level incentives and dumping fees. Martec’s team recognized early that the TAM could not be assessed simply by projecting demand; it had to be bounded by the realities of supply.

Supply and Demand

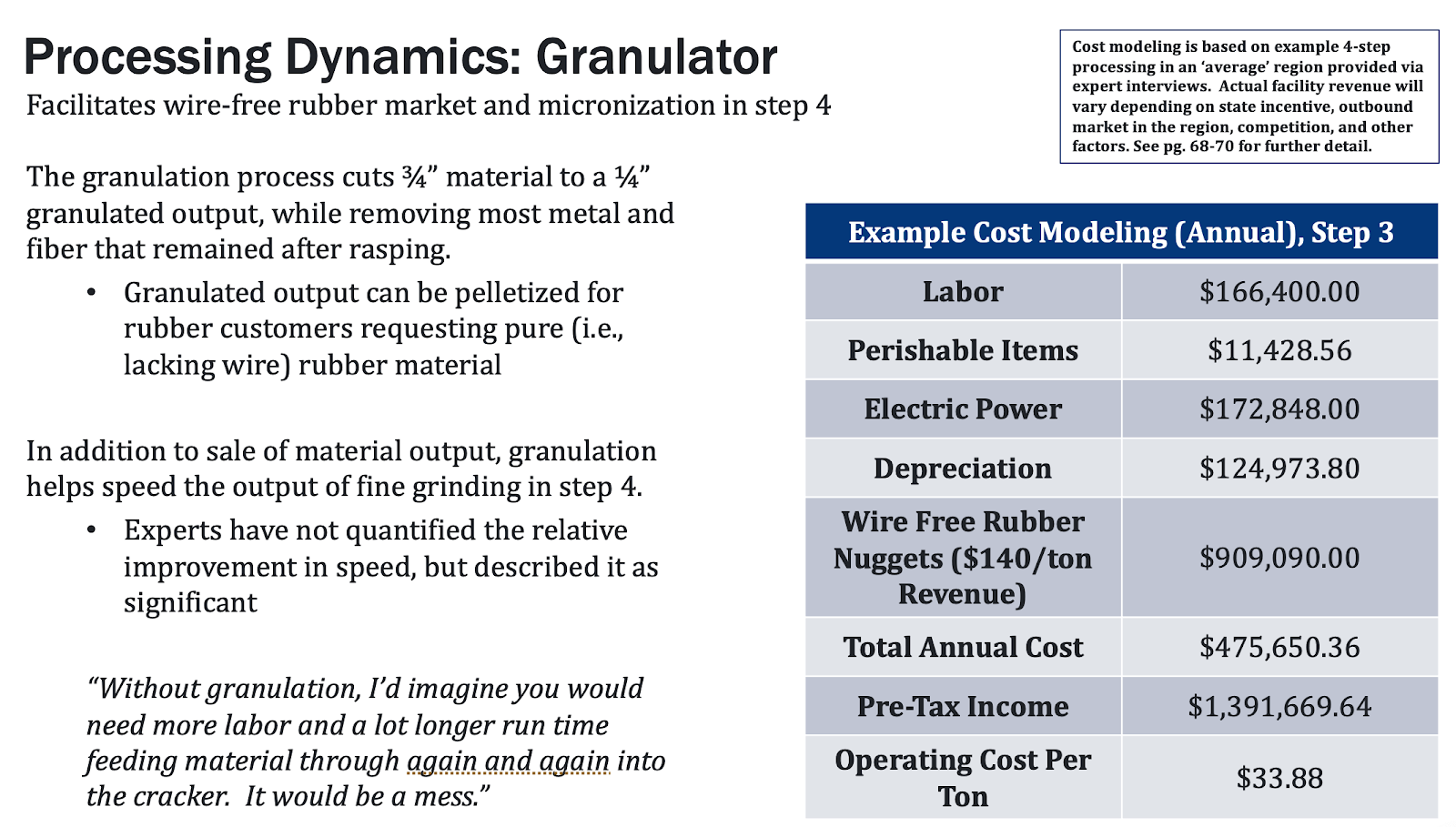

The supply side required careful segmentation. Passenger cars, light trucks, and heavy-duty on- and off-road trucks each produced tires with different lifespans, unit volumes, and rubber content. Martec triangulated multiple data streams: syndicated databases tracking vehicles in operation and miles driven, long-term (15-year) production and recycling statistics showing that roughly 85–90% of new annual tire production was offset by recycled volumes, and primary interviews with industry experts: recyclers, dealers, and collection operators.

The research team confirmed that, while there were far more tires in use than newly produced each year, the recycling stream tracked closely with new production, meaning recycled supply was both constrained and relatively predictable in aggregate.

The demand side proved equally complex. Recycled tires flowed into a spectrum of applications:

- Resale as used tires, where traders relied on historical quality from suppliers and often purchased sight unseen

- Crumb rubber for playgrounds and landscaping mulch, often mandated in school projects for safety reasons

- Agricultural uses, where shredded rubber supplemented soil stabilization

- Exports, where whole or partial tires were shipped abroad

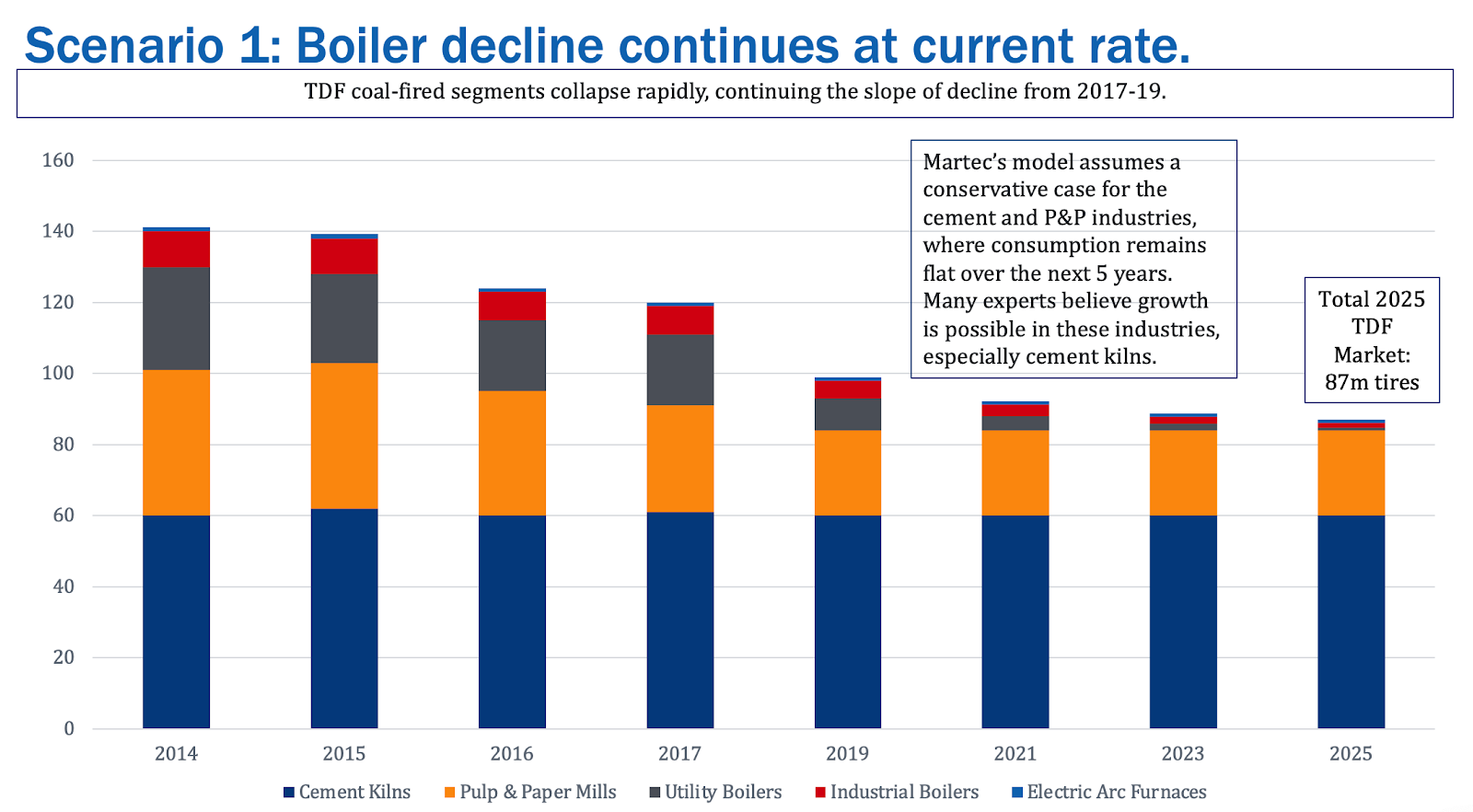

- Tire-derived fuel (TDF), burned in cement kilns, power plants, and paper mills under both long-term contracts and spot sales

Each of these markets carried distinct demand cycles, pricing, and reputational considerations. For example, playground mulch benefited from positive sustainability perceptions, while TDF faced environmental scrutiny, despite its efficiency as a fuel substitute.

An Added Layer of Complexity

What made the analysis especially instructive was the role of regionality. Recycling economics are highly sensitive to logistics: sourcing used tires and delivering recycled output both become cost-prohibitive beyond a defined radius.

Martec’s analysis showed that the company’s Serviceable Available Market (SAM) was not national in scope but constrained by geography. In practice, the recycler could realistically access about half of the total U.S. TAM, given its facility footprint and contract network.

The outcome gave the private equity sponsor a reliable, data-driven basis for its acquisition decision. By modeling both supply- and demand-side dynamics, calibrating TAM against regional SAM boundaries, and validating assumptions through triangulated data, Martec demonstrated that the company was well-positioned to capture meaningful growth.

This case underscores a core theme of market intelligence in diligence: true market sizing is not about inflating categories or straight-lining growth, but about carefully balancing inputs, outputs, and real-world constraints to provide data-informed confidence in investment theses.

Clients consistently share their appreciation for our transparency in modeling. This goes beyond consistency in basic sourcing as our consulting teams share the excel file and walk through each element of our logic for every demand driver, moderator, unit, price, input, and projection so the investor/client is armed with understanding and conviction around the volume and value in the market.

Chief Takeaways

If the tire recycling analysis illustrates anything, it’s that credible market intelligence is as much about disciplined definition as it is about data collection. Every model is only as strong as the assumptions that underpin it. The most sophisticated diligence exercises begin with a few simple, explicit choices—about units, value bases, and scope—that determine whether the results will hold up under scrutiny.

Clarity on what’s being measured may sound elementary, but it’s surprisingly rare. Measuring demand in units versus dollars, for instance, can lead to dramatically different interpretations of growth if pricing is volatile or if value-added services are expanding faster than core products. Likewise, deciding whether to measure at list price, transaction price, or net-of-discounts affects not only the total market size but also the apparent profitability of the opportunity. The best diligence models make these choices overt and transparent so investors can understand exactly what is, and isn’t, reflected in the numbers.

The next challenge is matching segmentation to the investment thesis. A sound model doesn’t just divide the market for convenience; it divides it according to the strategic realities that will shape the target’s future. That might mean splitting demand by customer type or application, differentiating premium from value-tier offerings, or accounting for whether growth will flow through direct channels, distributor networks, or digital platforms.

Geography often proves to be the most decisive segmentation variable of all. As the tire recycling case showed, logistics, regulation, and regional proximity can sharply constrain access to both supply and customers. Ignoring these constraints can make even the most elegant market model irrelevant to the deal at hand.

Finally, rigorous market intelligence requires an honest confrontation with common analytical pitfalls. Overstating the total addressable market by counting every dollar in an adjacent category may make a slide look impressive, but it rarely survives investor questioning. Straight-lining growth from end-market compound annual growth rates (CAGRs) ignores the real-world frictions of capacity, competition, and channel dynamics. Treating a company’s SOM as a statement of ambition, rather than a reflection of verified go-to-market reach, can inflate expectations and erode credibility.

The best diligence practitioners don’t just size markets—they clarify them. They define the edges, acknowledge the constraints, and translate complexity into context. That’s what transforms a set of market statistics into a decision-making tool.

The Confidence that Comes from Knowing a Market Opportunity

Market Intelligence is often the anchor of commercial due diligence. Done well, it provides not just data and numbers, but clarity: clarity on where opportunity exists, what boundaries define it, and what risks may erode it. With disciplined triangulation, explicit scoping, and careful avoidance of common pitfalls, investors can replace guesswork with grounded scenarios.

As the tire recycling example shows, the best diligence work turns complexity into confidence—equipping investors to move forward with a data-informed view of market opportunity.

For the next installment of our ongoing series exploring CDD in the Private Equity space, we will explore CDD for Competitive Intelligence, exploring the critical importance of understanding the competitive landscape. If you are interested in a deeper dive on market analysis for investors, click here for a whitepaper that dives much deeper on this specific topic.